House Passes Representative Angie Craig’s Bipartisan Legislation to Improve Small Business Loan Program

The bill would streamline the loan application process and increase the maximum loan amounts available to small businesses

WASHINGTON, DC — Today, the U.S. House of Representatives passed a bipartisan bill introduced by U.S. Representatives Angie Craig (D-MN), Steve Chabot (R-OH), Sharice Davids (D-KS) and Young Kim (R-CA) to improve the Small Business Administration's (SBA) 504 Loan Program. Among other provisions, the 504 Modernization and Small Manufacturer Enhancement Act would increase maximum loan amounts, streamline the loan process and provide additional support to manufacturers who apply for the loan from local SBA offices.

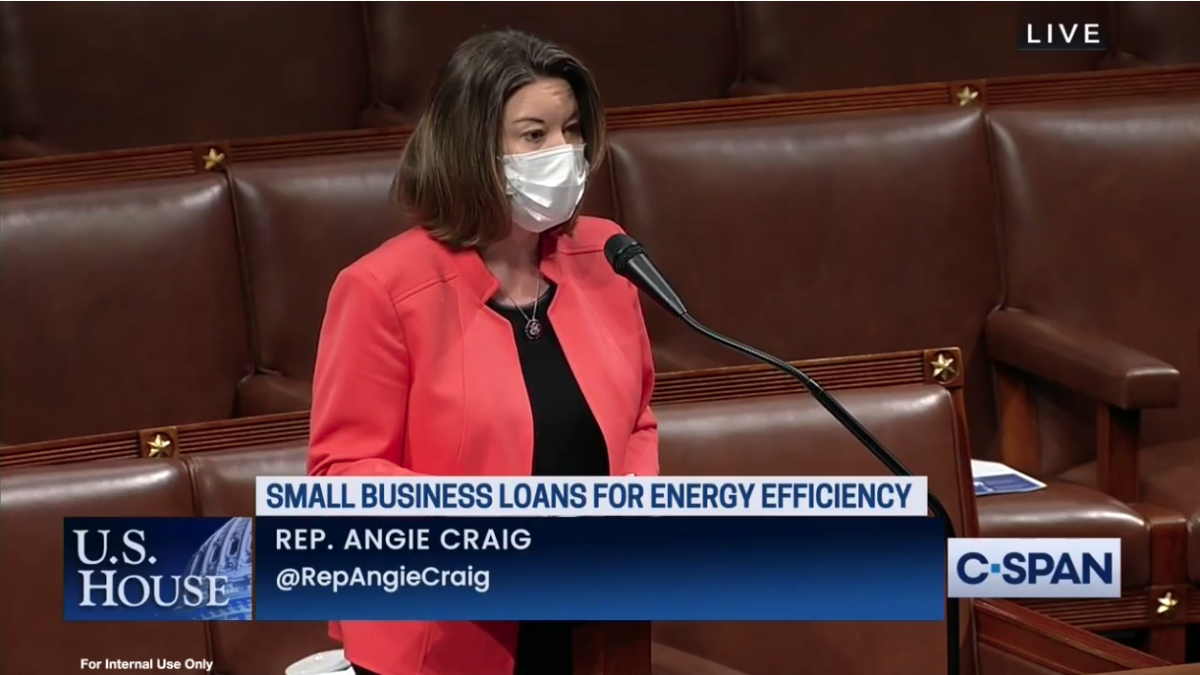

Earlier this week, Craig spoke on the House floor in support of her legislation, urging her colleagues to support efforts to promote the economic development of small businesses across the country. In her speech, Craig highlighted the story of Rosemount, Minnesota native Nate Bry who, with the help of a 504 loan, was able to build a successful small manufacturing company in his hometown.

"Nate's story – like so many others – is proof that the 504 loan program can change the lives of small business owners in this country," said Representative Craig. "This program ensures that small businesses like Nate's are able to succeed – bringing home the job growth and economic stability that our communities are striving for – especially as we emerge from this devastating economic crisis."

"Because these are not simply businesses," Craig continued. "These are livelihoods, family traditions and priceless contributions to our communities. And we have an opportunity to support them by taking action today."

Video of Representative Craig's remarks is available here.

Craig's bill, which was introduced in the 117th Congress earlier this year, passed the House with overwhelming bipartisan support. Specifically, the 504 Modernization and Small Manufacturer Enhancement Act:

- Increases the maximum loan amount to $6.5 million

- Requires SBA District Offices to partner with SBA Resource Partners to provide entrepreneurial development assistance to loan recipients

- Decreases project costs for small manufacturers and adjusts the job creation/retention requirements

- Adjusts building occupancy standards, collateral requirements and debt refinance parameters

- Streamlines numerous administrative processes associated with the 504 loan closing process by allowing accredited Certified Development Companies to perform numerous closing-related tasks, such as reducing project costs